Farmland is worth it's discounted cashflow. Period.

It may sell for more but at some point it returns to trend. It can correct either in price or in time.

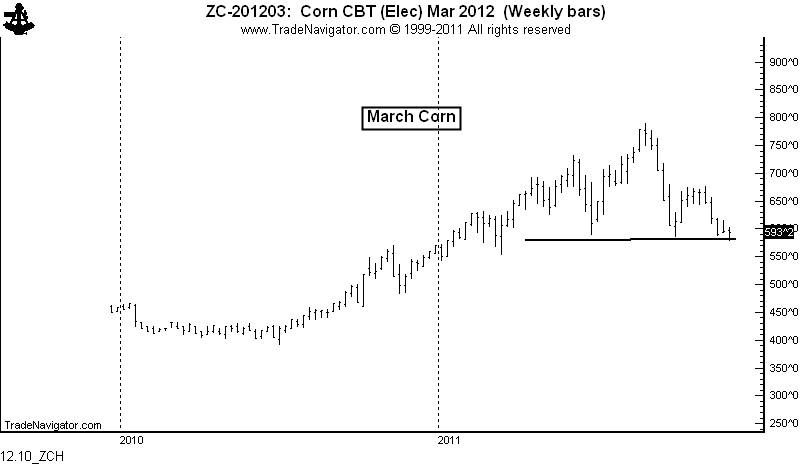

Corn is trading at $5.94, down considerably from it's $7.99 record high earlier this year.

Three recent stories.

MarketWatch Dec. 7, 2011:

Macquarie executive warns of U.S. farm bubble

U.S. farmland prices may be heading for a downward correction after having increased sharply in recent years because of speculative investment, low interest rates and high prices of crops, a Macquarie Agricultural Funds executive said Wednesday.

A bubble may be building up and there is a cause for caution because returns are getting squeezed, Daniel Hough, agricultural product specialist with Macquarie, said on the sidelines of an agriculture conference.There is no justification for U.S. farmland prices to be three-to-four times higher than land where the same crop is planted in Brazil, or 30 times the corresponding prices in Russia, he said. High yielding crop land in the U.S. is now priced around $12,000-$15,000 a hectare, compared with $3,500/hectare in Brazil and $500/hectare in Russia.Citing data from the Federal Reserve Bank of Chicago, Hough said that in the year to June 30 there was an average 17% increase in farmland prices across Indiana, Illinois, Iowa, Michigan and Wisconsin, the biggest rate of increase for any year since 1977. According to the U.S. Department of Agriculture, farmland prices are up 40%-70% during 2005-2010 in the Midwest.Hough said speculators are investing in land on the expectation of future capital growth, but returns accruing from production on the land have declined and are now anywhere between 1%-2% annually. Around half of U.S. farmland is now managed by non-owners....MORE

From Big Picture Agriculture:

Production Expenses Rise More Than $30 Billion in 2011

After falling $12.0 billion (4.1 percent) in 2009 and rebounding a relatively modest $4.5 billion (1.6 percent) in 2010, total production expenses are set to rise $34.4 billion (12.0 percent) in 2011 to a nominal record $320.0 billion. The 2011 jump resembles the large increases in production expenses in 2007 and 2008. This is the first time that expenses will have exceeded $300 billion. When adjusted for inflation, 2011 expenses also set a record, surpassing the previous peak reached in 1979.Finally, from Peter Brandt, Dec. 12, 2011:

On the price side, total expenses are affected by an expected 12-percent increase in the Production Items, Interest, Taxes, and Wage Rate (PITW) prices-paid index...MORE

The Corn market is poised for a 35% price decline. Being short Corn futures is one way to play this decline. Another way is to be long certain stocks....HT: A reader and also at Abnormal Returns

...Below is a chart of March Corn futures. The massive H&S top could take Corn from $5.90 to to $3.70 per bushel. This represents a gain of $11,000 per short-side contract of Corn futures. Corn is at all-time high prices relative to competing grain products (Wheat, Soybean Meal). Even though Corn has already dropped $2 per bushel from its high, it remains overpriced. The only factor keeping Corn prices up is ethanol

production.

...MORE

There's a reason I write stuff like:

Taking on debt for productive assets is bondage.

Taking on debt for purposes that don't produce a return is slavery.

In the farm biz the K.C. Fed is already warning member banks not to loan against inflated land values.

They should also beware of loans against top-tick cash flows.

-"Farm Debt and the Farm Real Estate Bubble"