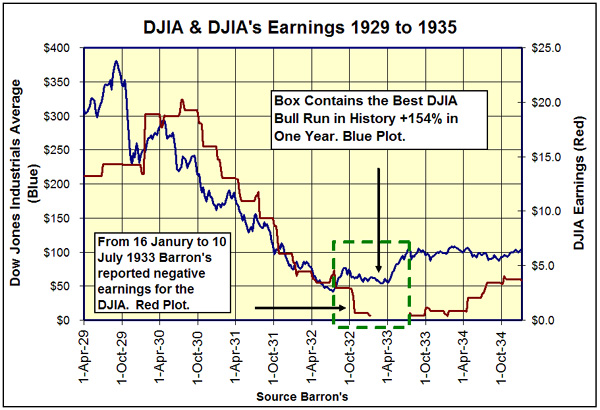

...Looking at the recovery from July 1932 to July 1933 the above chart shows a very weak recovery. The reality is that from July 1932 to July 1933 the DJIA increased by 154% even while the Great Depression caused bank closings, DJIA stock earnings were negative and US unemployment was over 25%!

July 1932 to July 1933 is the best year the DJIA ever had in its 123 year history. I suspect this historic bull move made money for only a very few. The 1929-1932,

-89% decrease killed off most of the 1920’s investment-banking industry’s customers. By 1932, the very thought of investing in the stock market, or borrowing money from a bank produced a sense of revulsion and dread in most people.,,,MANY CHARTS

And there have been a fair number of 50% rallies over the years. When it comes, just remember our January 20 post "This is What a Bear Market Looks Like Folks":

This is the sixth time I've posted this cartoon since September 5.

(That's pre-Lehman, pre-Merrill, pre-AIG, pre-Wamu, pre-Wachovia etc.)

I'll keep posting it until the bottom-callers get sick of me.So we can look for a bounce but think of these names as a trade; bear markets can suck you in. When I first came to the market, one of the older traders told me he was saved in the '73-'74 bear by a cartoon:

(click to enlarge)

That's Alfred Frueh's January 16, 1932 New Yorker classic, "Just around the Corner", commenting on President Hoover's statement that "Prosperity is just around the corner".

Here's the headline story from Bespoke Investment Group:

Go to Bespoke for their commentary.