From the Wall Street Journal:

Hundreds of big investors and top executives will descend on the United Nations headquarters next Thursday to grapple with Wall Street's latest fashionable worry: how global warming is affecting the climate -- for investing.

Investors are increasingly trying to come to grips with the uncertainty about how the U.S. government will address the issue of global warming, and what effects that will have on businesses from power companies to insurers.

...Executives from Lehman, Goldman Sachs Group Inc., UBS AG, Deutsche Bank, Bank of America Corp. and AIG Investments, as well as state pension funds, will attend the Valentine's Day summit, which features Al Gore as keynote speaker at a closed-door luncheon and discussions such as "Unleashing the Business Potential for Clean Energy.">>>MORE

The mantra will, of course, be something to the effect "What the markets hate is uncertainty".

This translates, of course, to "We want subsidies, mandated use of our products, tariffs and a ban on any competition".

They won't, of course, say this. The CERES volk are more sophisticated than the head of the German Solar Energy Association who said, referring to solar subsidies (From the BBC):

However, as Gerhard Stry-Hipp, managing director of the German Solar Industry Association says, this is not paid for by the government.So I don't leave the wrong impression, let me put it plainly- I'm pro alternative energy."It's not a subsidy in a formal way because it's not state money. The utilities are gathering that money and there is an additional bonus the rate payers [consumers] have to pay and with this money, the electricity from the renewables is paid."

I am also a pro investor.

Right now, alt-energy isn't economically viable. So you are dependent on politicians.

My problem is, years ago I got this fiduciary thing into my head and now I can't seem to shake it.

Investing in rent-seeking businesses takes on an added layer of risk.

It is more dangerous than other investments and you must:

a) be aware of when you are in one and

b) monitor the political landscape continuously and very closely.

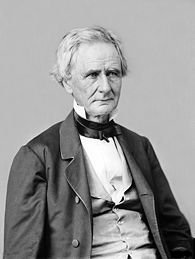

I'll close with my standard quote, from Simon Cameron.

From our post on biofuels, March '07:

Finally for investors in rent-seeking organizations there is the real risk that the politicians will change the rules. Heed the words of Sen. Simon Cameron (R&D!-Pa.):

"The honest politician is one who when he is bought, will stay bought."